Navigating the Complexity of EMIR Refit

In the ever-evolving landscape of financial regulations, staying ahead of the curve is not just an advantage: it’s a necessity. As the European Market Infrastructure Regulation (EMIR) undergoes significant updates and amendments, the demands on financial institutions, market participants, and trade repositories have never been greater. The new EMIR Refit framework aims to enhance transparency, streamline reporting, and reduce regulatory burdens. But adapting to these changes requires the right tools and expertise.

Introducing the Subscribe to EMIR (S2E) Solution: Your Compliance Companion

Welcome to a new era of compliance and efficiency with our EMIR Refit software solution, meticulously designed to simplify your regulatory compliance outcome.

The S2E Advantage

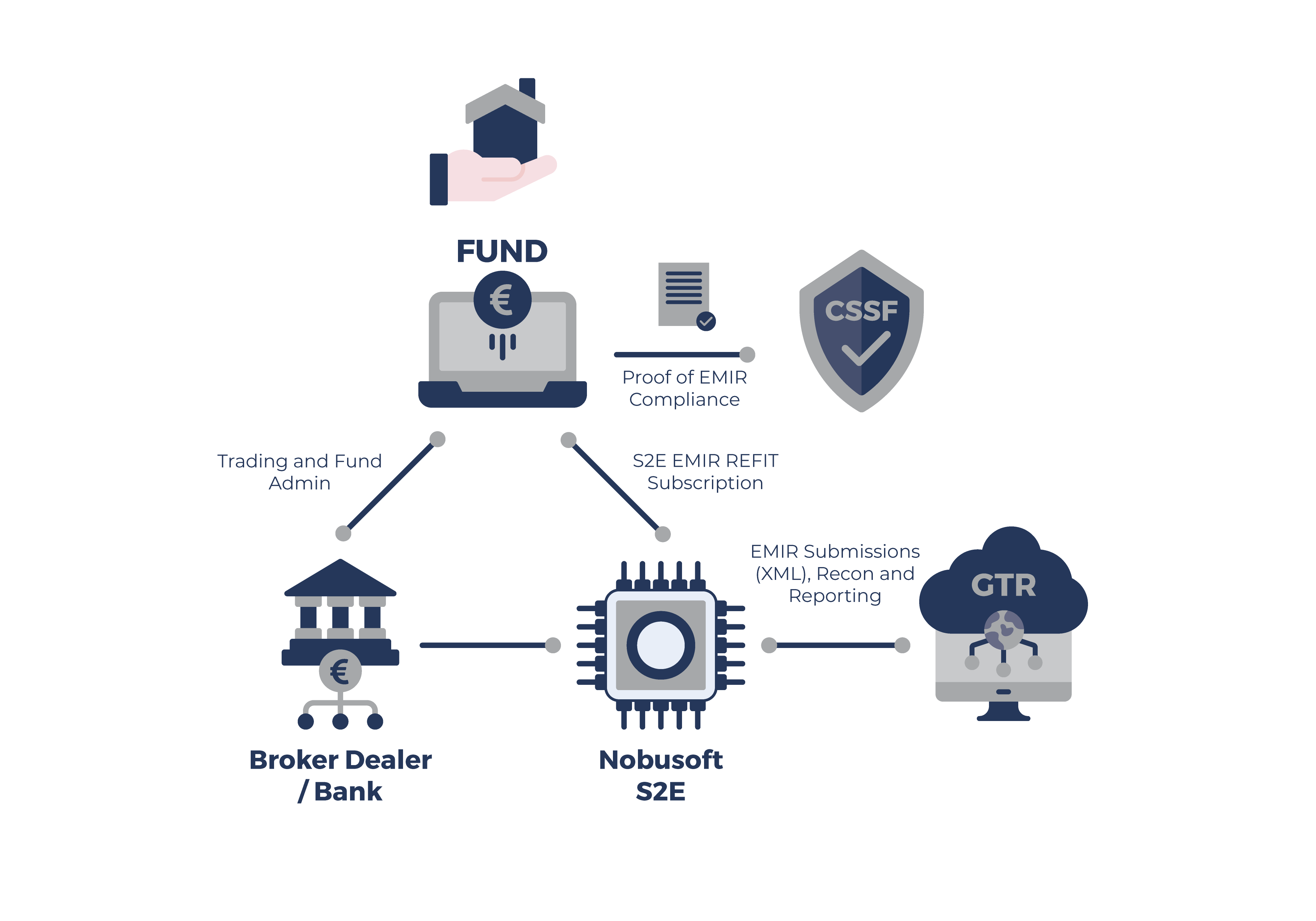

The Nobusoft S2E Solution offers a comprehensive EMIR reporting platform that addresses the new REFIT requirements and provides a robust workflow to manage your EMIR submissions and regulatory reporting requirements. The Nobusoft S2E platform has been enhanced to address the dozens of new EMIR REFIT data field requirements, with augmented data validation, automated error detection and alerting. The S2E platform fully conforms to the new REFIT xml submissions formats, ensuring accuracy and reliability.

The streamlined workflow helps you manage the matching, reconciliation and exception management process with minimal effort. This coupled with the remediation and resubmissions process ensures your reports are accurate, current and remain compliant.

A subscription to S2E is designed as a simple to use self-service platform. The solution is coupled with access to trained service agents to provide a comprehensive operational support service. The support team will help you in addressing data deficiencies and alerts from the Global Trade Repository (GTR) to ensure your reports are always generated and available on-demand. The Nobusoft team’s expert consulting and advisory, facilitates the onboarding process to get you up and running quickly, typically in three weeks, to help you gain full control of your data.

The Nobusof S2E solution is delivered as a cloud based subscription on the AWS cloud platform and leverages all of the AWS encryption and data security features. It is deployed in a segregated, single-tenanted environment for each client providing an operationally robust process and ensuring that your data is secure.

EMIR Refit, or the European Market Infrastructure Regulation Refit, represents a significant revision and enhancement of the original EMIR (European Market Infrastructure Regulation) framework. EMIR Refit was introduced to streamline and improve the functioning of the European derivatives market, making it more efficient and transparent while reducing regulatory burdens. Here’s a more detailed overview of EMIR Refit:

EMIR Refit simplifies reporting requirements for market participants. It introduces a more proportionate approach to reporting by reducing the scope of asset classes that need to be reported.

The regulation includes a broader exemption for intragroup transactions. This means that transactions between companies within the same group are subject to reduced reporting requirements.

EMIR Refit enhances the quality of data reported to trade repositories, ensuring that the data is accurate, complete, and consistent across different market participants.

The Refit introduces a revised regime for clearing thresholds, which determine whether certain derivatives contracts must be cleared through central clearing counterparties (CCPs). This change aims to align clearing obligations more closely with the systemic risk posed by different market participants.

EMIR Refit introduces a new category of market participants known as Small Financial Counterparties (SFCs). These are financial counterparties with relatively low derivative activity, and they are subject to reduced obligations.

The Refit includes provisions for the recognition of third-country central counterparties (CCPs). This is important for derivatives trading with entities outside the EU, ensuring that cross-border activities are appropriately regulated.

The threshold for NFCs determining whether they are subject to clearing obligations or risk mitigation requirements has been raised, exempting more entities from certain EMIR obligations.

EMIR Refit allows for the discontinuation of derivatives reporting for some small and non-financial counterparties under certain conditions.

The regulation also addresses margin requirements for non-cleared OTC (over-the-counter) derivatives. It aligns the phase-in periods for initial margin requirements with international standards and introduces a small counterparty exemption.

EMIR Refit enhances risk mitigation techniques, such as portfolio compression, to reduce counterparty credit risk. It also allows more flexibility in the application of such techniques.

EMIR Refit improves transparency by requiring financial counterparties to keep records of derivative contracts, ensuring that they can be efficiently retrieved.

The European Commission is required to review the impact and effectiveness of the EMIR Refit regulation to ensure that it meets its intended objectives.

EMIR Refit is a response to lessons learned from the implementation of the original EMIR regulation and aims to strike a balance between reducing regulatory burdens and ensuring the continued stability and transparency of the derivatives market in the European Union. Market participants, including financial institutions, have had to adapt their operations and reporting processes to comply with the changes introduced by EMIR Refit. Compliance with these regulations is essential for entities involved in derivatives trading within the EU.

Unlock EMIR Compliance with Our Cloud-Based Subscription Service

Navigating the complexities of EMIR (European Market Infrastructure Regulation) compliance doesn’t have to be a daunting, resource-intensive task. At Nobusoft, we understand the challenges that financial institutions, market participants, and trade repositories face in adhering to EMIR’s evolving regulatory landscape.

That’s why we’ve developed a subscription-based solution that streamlines and simplifies your path to EMIR compliance. Our innovative approach ensures you meet your regulatory obligations without the need for costly in-house infrastructure or extensive compliance teams.

Key Features of S2E:

1. Streamlined Reporting

S2E simplifies the reporting process, ensuring that you can efficiently meet your data reporting requirements. We help you report accurately and on time, reducing the risk of regulatory fines.

2. Intragroup Transactions Management:

S2E caters to the needs of financial institutions, trade repositories, and other market participants by offering advanced intragroup transactions management tools to handle complex intra-group trade reporting and exemptions.

3. Data Quality Assurance and Security

Compliance hinges on accurate and complete data. Delivered on the AWS Cloud in a secure environment, S2E’s validation software ensures that the data reported to trade repositories is of the highest quality, reducing the risk of data discrepancies and regulatory complications.

4. Small Financial Counterparty Support

We’ve incorporated the provisions of EMIR Refit, including specific support for Small Financial Counterparties (SFCs), to cater to a broad spectrum of market participants.

5. Ongoing Updates and Regulatory Alignment

Our solution evolves with the regulatory landscape. We closely monitor changes to EMIR and other related regulations to keep you up to date and compliant.

6. Comprehensive Support:

Beyond just offering software, we provide exceptional ongoing operational support and training to make sure you’re getting the most out of our solutions

Benefits of Our Subscription:

Cost Efficiency

Our subscription model eliminates the need for significant upfront investments in compliance infrastructure, helping you optimize your compliance budget.

Time Savings

Our subscription model eliminates the need for significant upfront investments in compliance infrastructure, helping you optimize your compliance budget.

Reduced Risk

Accurate and timely reporting reduces the risk of non-compliance, fines, and regulatory headaches, safeguarding your reputation and operations.

Scalability

Our subscription can grow with your business, adapting to changing needs and requirements.

Peace of Mind

With our team of experts by your side and ongoing updates to ensure alignment with regulatory changes, you can enjoy peace of mind regarding your EMIR compliance.

Why Choose Nobusoft?

Proven Expertise

With a history of serving financial institutions and market participants, we've earned the trust of regulatory authorities and market players. Our solutions are crafted by experts who understand the nuances of EMIR compliance.

Comprehensive Suite

Our EMIR Refit software suite covers the entire spectrum of compliance activities, from trade reporting and reconciliation to data quality assurance and regulatory updates. No matter your needs, we have a solution that fits.

Consultancy and Software Solutions

We don't believe in one-size-fits-all solutions. Our consultancy team works closely with you to tailor our software to your unique requirements, ensuring a perfect fit.

Adaptability

We understand that the regulatory landscape is in perpetual motion. Our solutions are designed to evolve with changing EMIR requirements, market dynamics, and business models, ensuring that you're always compliant and up to date.

Comprehensive Support

Beyond just offering software, we provide operational exceptional support and ongoing training to make sure you're getting the most out of our solutions

Join the Compliance Revolution

EMIR compliance no longer needs to be a daunting challenge. With our subscription-based solution, we empower you to meet your EMIR obligations efficiently and effectively, allowing you to focus on your core financial operations.

Subscribe to EMIR compliance solution today and join the compliance revolution. Compliance made simple, efficient, and cost-effective – that’s what we’re all about at Nobusoft.